The W-2 form, also known as the Wage and Tax Statement, is a crucial document used for reporting an employee’s annual earnings and tax withholdings to the Internal Revenue Service (IRS). It serves as a comprehensive summary of an individual’s income earned during the tax year and the taxes withheld by their employer. This article delves into the purpose and importance of the W-2 form for both employees and employers.

What is a W-2 Form?

The W-2 form is an official document that outlines various financial aspects of employment, such as wages, tips, commissions, and other compensation, as well as details about taxes withheld from an employee’s paycheck. The W-2 form is crucial for individuals when preparing and filing their annual income tax returns. Luckily nowadays, this form can be easily created using online tools like thepaystubs.com/w2-form-generator.

The Purpose of the W-2 Form

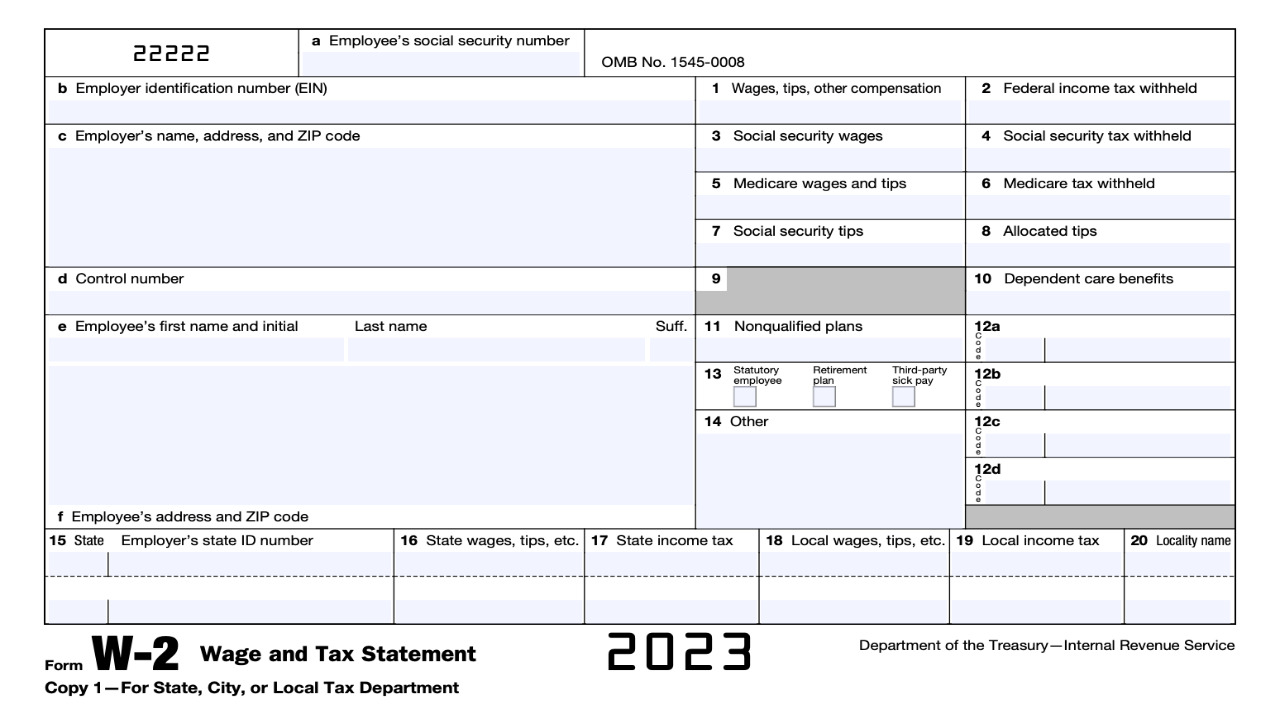

Income Reporting

The primary purpose of the W-2 form is to report an employee’s annual income earned from their employer. It includes not only the wages received but also other forms of compensation, such as bonuses, tips, and taxable fringe benefits.

Tax Withholding Information

The W-2 form provides a breakdown of the taxes withheld from an employee’s paycheck throughout the year. These withholdings typically include federal income tax, state income tax (where applicable), Social Security tax, and Medicare tax.

Tax Compliance and Verification

The W-2 form is essential for both employees and the IRS to ensure tax compliance. It allows the IRS to cross-verify the income reported on an individual’s tax return with the information provided by their employer, reducing the likelihood of tax fraud.

Importance for Employees

Facilitates Tax Filing

One of the most significant benefits of the W-2 form for employees is that it simplifies the tax filing process. The information provided on the W-2 form allows taxpayers to accurately report their income and tax withholdings, ensuring they meet their tax obligations.

Access to Tax Refunds

For many employees, tax refunds are a welcome financial boost. The W-2 form helps determine whether an employee is eligible for a tax refund by calculating whether they overpaid their taxes throughout the year.

Understanding Compensation Breakdown

The W-2 form provides a detailed breakdown of an employee’s compensation, including any additional income sources, which can be helpful for budgeting and financial planning.

Applying for Loans or Credit

When applying for loans or credit, financial institutions often require copies of recent W-2 forms. These documents serve as proof of income and can influence the loan amount an individual is eligible for.

Importance for Employers

Legal Obligation

Employers are legally required to issue W-2 forms to their employees and submit copies to the IRS. Failure to do so can result in penalties and fines for non-compliance.

Accurate Tax Reporting

The W-2 form ensures that employers report accurate information about their employees’ wages and tax withholdings. This helps maintain the integrity of the tax system and ensures that employees’ tax obligations are met.

Avoiding Penalties

Providing incorrect or late W-2 forms can lead to penalties for employers. Timely and accurate submission of W-2 forms is crucial to avoid unnecessary fines and legal issues.

Employee Relations and Trust

Issuing W-2 forms promptly demonstrates transparency and professionalism in an employer-employee relationship. It helps build trust and confidence among employees that their employer is adhering to all tax-related obligations.

Conclusion

In conclusion, the W-2 form plays a vital role in the taxation process for both employees and employers. For employees, it simplifies tax filing, enables access to tax refunds, and provides valuable financial information. Employers must fulfill their legal obligations by providing accurate W-2 forms to their employees and the IRS, ensuring the smooth functioning of the tax system and maintaining a positive employer-employee relationship. Understanding the purpose and importance of the W-2 form is essential for all parties involved to navigate the tax season effectively.